SODOM & GOMORRAH: As technology becomes more complex, the temptation to apply it to the wrong fields intensifies. After the Russian Revolution of 1917, the newly formed Soviet Union began efforts at full scale industrialization. Much of the Soviet Union was still a feudal and agrarian society, and the new socialist paradise had to create an industrialized class of middle … [Read more...]

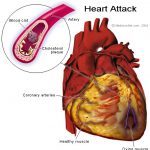

Silent Heart Attacks

SODOM & GOMORRAH: New data indicates that as many as half of all heart attacks may be "silent". This means that patients can have cardiac episodes that don't come with the typical gauntlet of symptoms such as extreme chest pain, shortness of breath, and cold sweats. The report, which was published on May 16th in the journal Circulation, found that nearly 45% of … [Read more...]

Google Continues to Chase Artificial Intelligence

SODOM & GOMORRAH: A little-talked-about facet of Google's business model and plan for itself is the end-game of making the search engine a brain implant. The idea was discussed briefly by Ben Gomes, then Vice-President of Search back in 2013. Gomes claimed that Google's innovation in wearables like Glass were stepping stones toward the company's ultimate … [Read more...]

Head Transplant Surgery Not Without Side Effects

SODOM & GOMORRAH: Dr. Sergio Canavero of Italy plans to lead a team of more than 150 doctors and nurses in the first human head transplant surgery in history. The patient is Valery Spiridonov, a 30 year old Russian man who has a rare form of spinal muscular atrophy. Mr. Spiridonov has volunteered for the procedure in hopes that he'll be able to walk again. … [Read more...]

CERN Accused of Plotting Portal to Hell

SODOM & GOMORRAH: Since before the Large Hadron Collider was first turned on, a series of lawsuits and conspiracy theories have been levied against the European Organization for Nuclear Research (known as CERN). CERN has been accused of ties with the occult, murder of microscopic civilizations, and plotting to open portals to the netherworld among other … [Read more...]